Manufacturing Cost Under Variable Costing . variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. learn what a variable cost is and how to calculate it for a company's production or sales. variable costing is a cost accounting method for calculating production expenses where only variable costs are. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. learn the difference between variable costing and absorption costing. It is also called direct costing or marginal. Find out the types of variable costs, how they differ from fixed. variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense.

from www.youtube.com

variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. learn the difference between variable costing and absorption costing. variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. Find out the types of variable costs, how they differ from fixed. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. variable costing is a cost accounting method for calculating production expenses where only variable costs are. It is also called direct costing or marginal. learn what a variable cost is and how to calculate it for a company's production or sales.

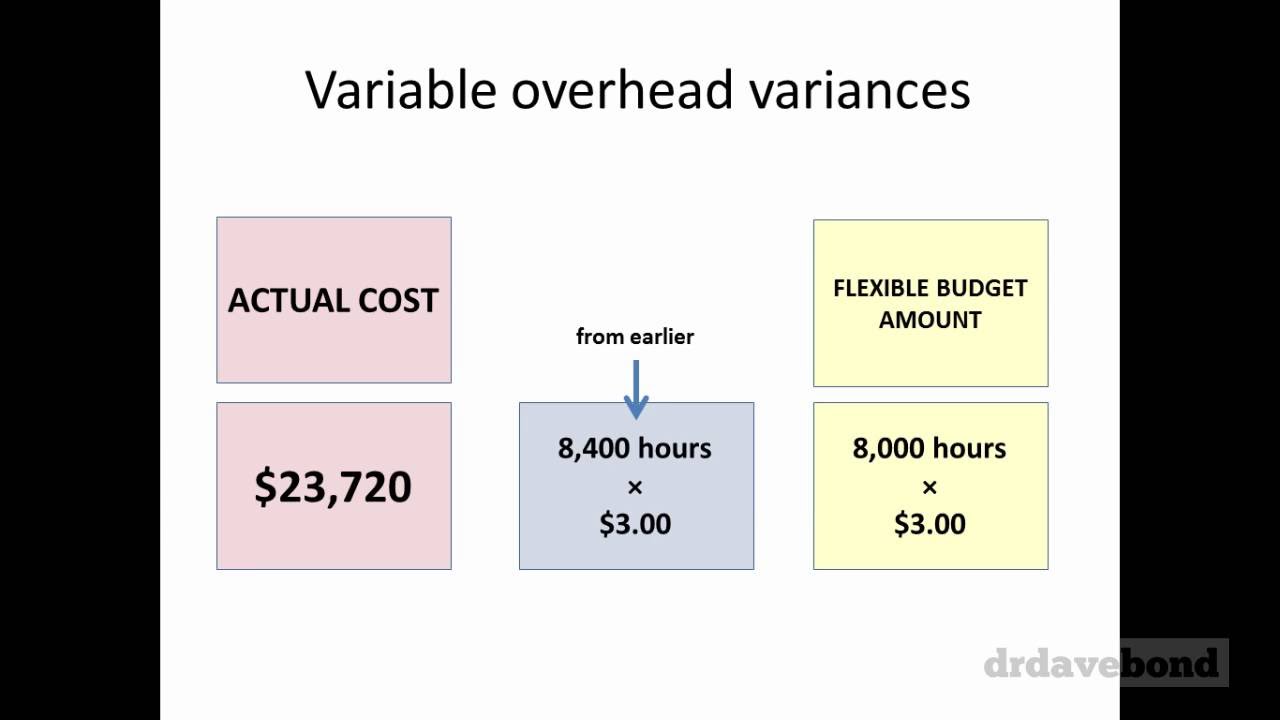

Flexible Budget Variances Variable Manufacturing Costs YouTube

Manufacturing Cost Under Variable Costing variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. learn the difference between variable costing and absorption costing. variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. Find out the types of variable costs, how they differ from fixed. It is also called direct costing or marginal. learn what a variable cost is and how to calculate it for a company's production or sales. variable costing is a cost accounting method for calculating production expenses where only variable costs are. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product.

From saylordotorg.github.io

Using Variable Costing to Make Decisions Manufacturing Cost Under Variable Costing learn the difference between variable costing and absorption costing. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. It is also called direct costing or marginal. Find out the types of variable costs, how they differ from fixed. variable costing (also known as direct costing) treats. Manufacturing Cost Under Variable Costing.

From pakmcqs.com

In variable costing, the variable manufacturing and fixed manufacturing Manufacturing Cost Under Variable Costing learn the difference between variable costing and absorption costing. Find out the types of variable costs, how they differ from fixed. learn what a variable cost is and how to calculate it for a company's production or sales. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of. Manufacturing Cost Under Variable Costing.

From www.slideserve.com

PPT Variable Costing A Tool for Management PowerPoint Presentation Manufacturing Cost Under Variable Costing variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged. Manufacturing Cost Under Variable Costing.

From www.inflowinventory.com

Learn How to Use the Total Manufacturing Cost Formula Manufacturing Cost Under Variable Costing variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. learn what a variable cost is and how to calculate it for a company's production or sales. It is also called direct costing. Manufacturing Cost Under Variable Costing.

From www.accountingformanagement.org

Exercise3 (Unit product cost under variable costing, breakeven point Manufacturing Cost Under Variable Costing Find out the types of variable costs, how they differ from fixed. learn what a variable cost is and how to calculate it for a company's production or sales. variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. variable costing is a costing method that includes. Manufacturing Cost Under Variable Costing.

From www.scribd.com

General Model For Variable Manufacturing Costs Variance Analysis PDF Manufacturing Cost Under Variable Costing variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. Find out the types of variable costs, how they differ from fixed. variable costing essentially focuses on. Manufacturing Cost Under Variable Costing.

From www.chegg.com

Solved Which of the following costs at a manufacturing Manufacturing Cost Under Variable Costing variable costing is a cost accounting method for calculating production expenses where only variable costs are. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. It is also called direct costing or marginal. learn what a variable cost is and how to calculate it for a company's. Manufacturing Cost Under Variable Costing.

From www.chegg.com

Solved 1) AAA Manufacturing Inc, makes a product with the Manufacturing Cost Under Variable Costing It is also called direct costing or marginal. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. Find out the types of variable costs, how they differ from fixed. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. variable costing (also known. Manufacturing Cost Under Variable Costing.

From www.numerade.com

SOLVED Which of the following costing methods charges all Manufacturing Cost Under Variable Costing It is also called direct costing or marginal. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. variable costing essentially focuses on assigning and tracking variable manufacturing. Manufacturing Cost Under Variable Costing.

From pakmcqs.com

If the fixed manufacturing cost expenses are under variable costing and Manufacturing Cost Under Variable Costing variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. variable costing is a cost accounting method for calculating production expenses where only variable costs are. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. learn the difference between variable costing. Manufacturing Cost Under Variable Costing.

From www.principlesofaccounting.com

Variable Versus Absorption Costing Manufacturing Cost Under Variable Costing learn what a variable cost is and how to calculate it for a company's production or sales. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. variable costing is a cost accounting method for calculating production expenses where only variable costs are. It is also called direct costing or marginal. learn. Manufacturing Cost Under Variable Costing.

From www.chegg.com

Solved 11. A manufacturing company that produces a single Manufacturing Cost Under Variable Costing learn the difference between variable costing and absorption costing. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. Find out the types of variable costs, how they differ from fixed. variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. variable. Manufacturing Cost Under Variable Costing.

From avada.io

How To Calculate Variable Cost? Guide, Examples and Extra Tips Manufacturing Cost Under Variable Costing variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. It is also called direct costing or marginal. learn the difference between variable costing and absorption costing.. Manufacturing Cost Under Variable Costing.

From slidesdocs.com

Company Manufacturing Cost Budget Excel Template And Google Sheets File Manufacturing Cost Under Variable Costing variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. variable costing is a cost accounting method for calculating production expenses where only variable costs are. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. learn what a variable cost is. Manufacturing Cost Under Variable Costing.

From courses.lumenlearning.com

Using Variable Costing to Make Decisions Accounting for Managers Manufacturing Cost Under Variable Costing variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense. variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. variable costing is. Manufacturing Cost Under Variable Costing.

From saylordotorg.github.io

Using Variable Costing to Make Decisions Manufacturing Cost Under Variable Costing It is also called direct costing or marginal. variable costing is a cost accounting method for calculating production expenses where only variable costs are. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. Find out the types of variable costs, how they differ from fixed. variable. Manufacturing Cost Under Variable Costing.

From example.ng

Variable Cost Definition, Formula, And 9 Examples Example NG Manufacturing Cost Under Variable Costing learn what a variable cost is and how to calculate it for a company's production or sales. learn the difference between variable costing and absorption costing. variable costing is a costing method that includes only variable manufacturing costs in the cost of a unit of product. It is also called direct costing or marginal. variable costing. Manufacturing Cost Under Variable Costing.

From slidesharenow.blogspot.com

Manufacturing Overhead Costs Include slideshare Manufacturing Cost Under Variable Costing variable costing is an alternative costing method that treats all fixed manufacturing costs as period costs and only variable. variable costing essentially focuses on assigning and tracking variable manufacturing costs to products or. learn what a variable cost is and how to calculate it for a company's production or sales. It is also called direct costing or. Manufacturing Cost Under Variable Costing.